-

What if you viewed busy season as an opportunity to make continuous improvement?

February 23 L&H CPAs and Advisors

L&H CPAs and Advisors -

The Internal Revenue Service's Direct File pilot program has expanded beyond internal testing of its free tax prep system to taxpayers in a dozen states.

February 22 -

Assessing your fees; partner comp; how to spend money; and other highlights from our favorite tax bloggers.

February 20

-

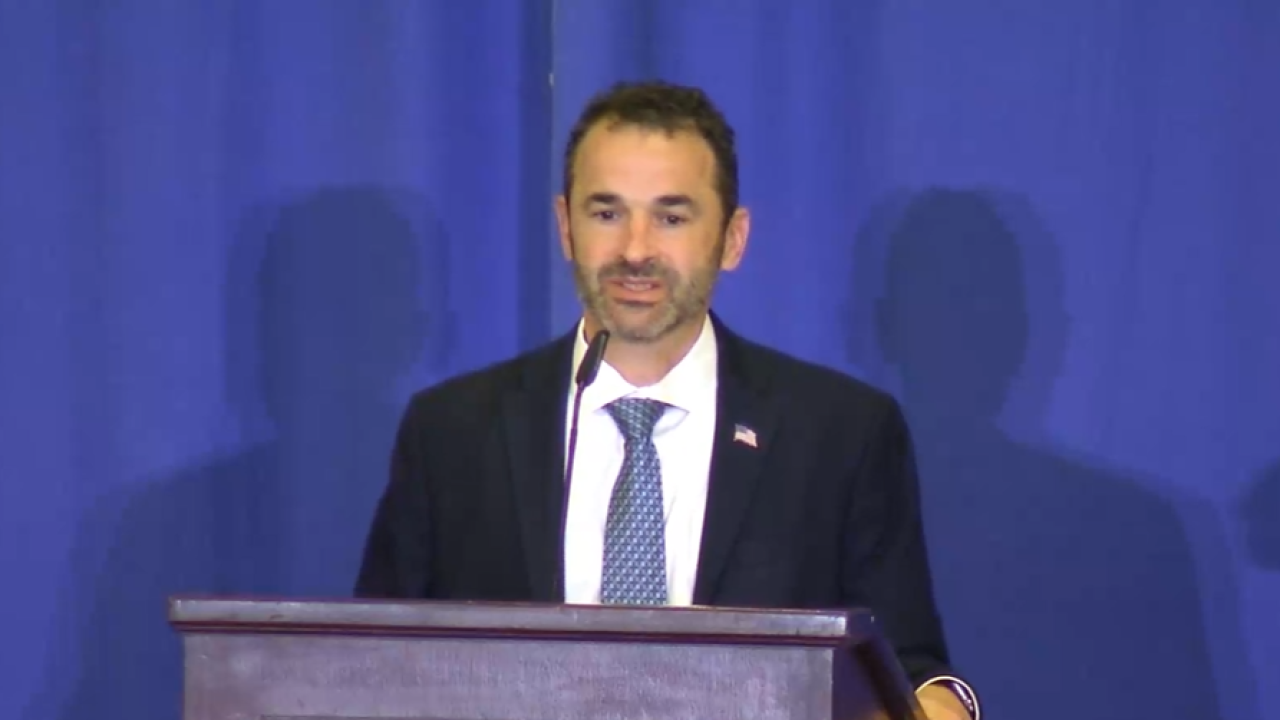

The Internal Revenue Service would be able to implement changes to the Child Tax Credit within weeks, IRS Commissioner Danny Werfel told Congress, and send out tax refunds promptly.

February 16 -

Some Taxpayer Assistance Centers will be open on Feb. 24, March 16, April 13 and May 18.

February 15 -

Due to technical issues, some batches may need to be resubmitted to IVES.

February 15 -

New technology systems and the addition of cryptocurrency on tax forms are just some of the IRS developments to watch in 2024.

February 15 -

The IRS is warning practitioners about a tactic that recurs every tax season.

February 13 -

SALT benefits; taxing blockchain tech; how to onboard; and other highlights from our favorite tax bloggers.

February 13

-

The Internal Revenue Service issued a warning about a new scam email this tax season pretending to come from tax software providers asking for the preparer's Electronic Filing Identification Number.

February 8