-

Add in the complexities of this year’s presidential race, and we have a recipe for uncertainty and fear.

October 23 EP Wealth Advisors

EP Wealth Advisors -

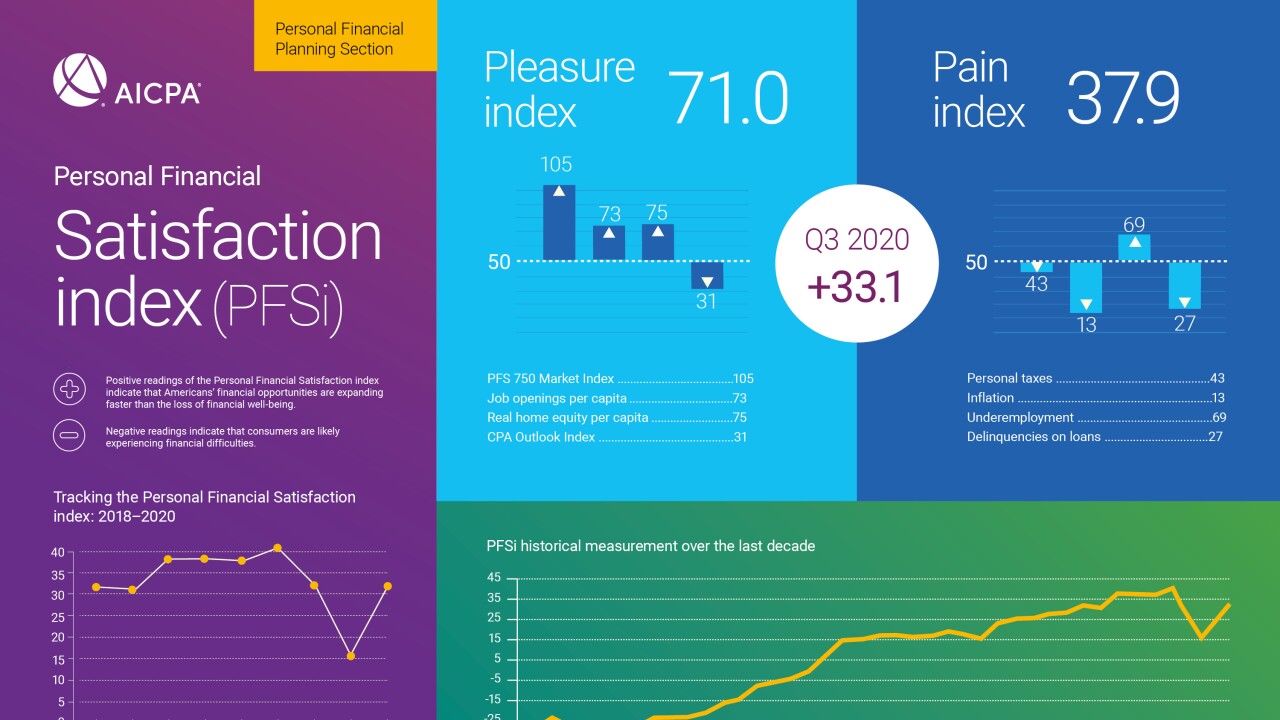

Financial satisfaction of people in the U.S. bounced back strongly in the third quarter, reversing the lows brought on by the coronavirus.

October 22 -

Democrats on the House Ways and Means Oversight Subcommittee want the agency to reverse the automated revocation of status for tens of thousands of nonprofits.

October 21 -

The CARES Act will play a critical role, according to Grant Thornton.

October 8 -

Whoever wins Nov. 3, there are sure to be changes ahead in tax rates and tax policy.

October 6 -

Robert T. Brockman was just putting the finishing touches on a new private equity fund when worrisome news arrived. Law enforcement agents had raided the home of a tax lawyer in Texas who had worked for him.

October 5 -

During the 2020 presidential campaign, Democratic candidates made many proposals for changes to the Tax Code, ranging from changes to the tax rates to the imposition of a new 5 percent excise tax and a national sales tax.

September 30 Erskine & Erskine LLC

Erskine & Erskine LLC -

You have five years to get your business-owner clients ready to leave.

September 29 Napier Financial

Napier Financial -

A New York Times story based on Donald Trump’s long-sought-after tax data shows he avoided paying income taxes for most of the past two decades and paid only $750 the year he was elected president.

September 29 -

Ratcliffe and other senior Ineos executives caused tension with the company’s auditor, PwC.

September 25 -

Hedge funds are planning to expand their presence in Florida, adding to a migratory trend as wealthy residents of northern states face the threat of higher taxes.

September 23 -

The regs clarify that certain deductions aren’t to be considered miscellaneous itemized deductions.

September 21 -

The tax hike will fund rebates for about 800,000 middle-class households.

September 17 -

The right communication strategy and strong deliverables are key.

September 9 Napier Financial

Napier Financial -

Effective tax management can add 1% percent to a portfolio annually, and potentially more in highly volatile years

September 8 Commonwealth Financial Network.

Commonwealth Financial Network. -

Clients’ spouses may be hiding assets in any number of tax-related ways.

September 3 -

It may seem counterintuitive, but paying appreciably more taxes in 2020 could save families a lot of money down the road.

August 31 Proquility Private Wealth Partners

Proquility Private Wealth Partners -

Credit Suisse Group AG is dealing with the fallout of a fraud at its international wealth management business, two years after it was criticized by a regulator in a similar case that rattled the bank and raised questions about controls.

August 28 -

Depending on the economy and the election, they could be on the chopping block as soon as 2021.

August 26 Cresset Asset Management

Cresset Asset Management -

Gifting embedded loss assets can avoid a step-down in basis and preserve capital losses. Here's how to go about it, under several scenarios.

August 24