Politics and policy

Politics and policy

-

New OBBBA restrictions mean wealthy donors lose deductions on smaller, routine gifts. Here is how to use DAFs and donation grouping to preserve tax benefits.

January 19 -

The tax shield on student loan forgiveness has expired. Here is how advisors can help clients lower their burdens.

January 6 -

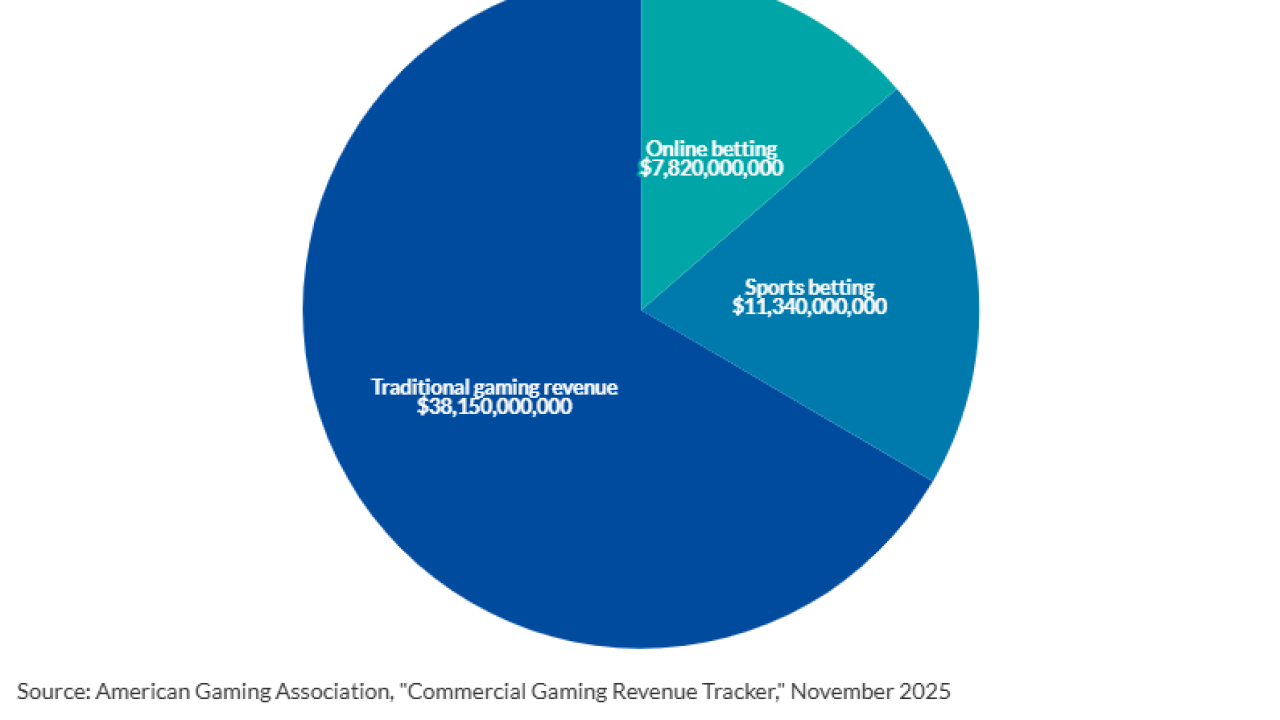

A tweak to the deductibility of gambling losses may not bring in a lot of tax revenue, but it could certainly alter a lot of wagers next year.

December 1 -

The higher standard deduction since 2017 has dramatically reduced itemization. But the new law provides incentive for teachers to consider whether that's feasible.

November 12 -

The industry asked for and received a delay in the rule from the IRS in 2023. Now that it's going into effect, here are the key implications for sponsors and savers.

November 11 -

The industry asked for and received a delay in the rule from the IRS in 2023. Now that it's going into effect, here are the key implications for sponsors and savers.

November 10 -

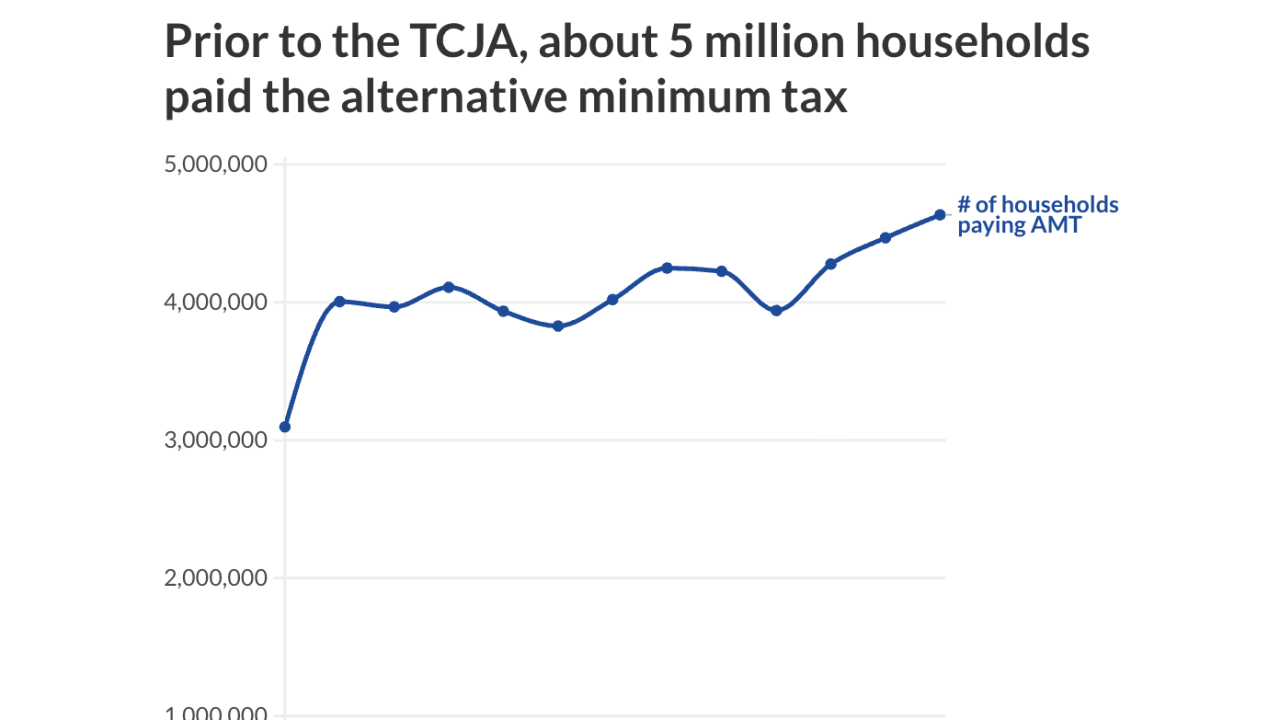

The One Big Beautiful Bill Act will boost the number of filers who must calculate their AMT. But that doesn't mean they're all going to have to pay it.

October 20 -

Starting next year, more households will need to calculate or pay the AMT. The rules are complicated. Here's how financial advisors can prepare themselves — and clients — for the changes.

October 20 -

While stock values get the most attention after the Fed cuts rates, they affect trusts, too. Some beneficiaries of entities without flexible distribution provisions could take a big hit.

September 29 -

The new tax law won't completely eliminate the complicated tax incentives for food on the job, but experts suggest businesses may change up their menus.

September 22 -

A limited federal tax credit, an above-the-line deduction for non-itemizers and restrictions on those of itemizers represent three of the biggest shifts under the new law.

September 11 -

The use of multiple entities as a means of shifting a high net worth client's yearly income could help rack up bigger breaks, with some caveats.

August 25 -

Even the wonkiest experts are struggling to keep up with the latest macroeconomic data. Here are the key factors to watch in the coming months.

August 11 -

But the new rules for deductions, capital-gains exclusions and estate planning merit a lot of strategic discussions for financial advisors and entrepreneurial clients.

August 7 -

The One Big Beautiful Bill Act presents some complexities for wealthy families, alongside its extension and expansion of provisions in the Tax Cuts and Jobs Act.

July 30 -

The Trump megalaw's expansion of opportunity zone credits and other investment approaches comes with caveats based on timing and taxes.

July 14 -

Politics are playing an outsize role in portfolio management. Here's how experts see the fixed-income sector changing under the pending One Big Beautiful Bill Act.

June 30 -

Rhode Island home sellers would see a conveyance tax rise 63%, and owners of million-dollar properties would pay an additional levy if the budget is signed into law.

June 24 -

The much-debated tax and spending legislation could be finalized next month, giving answers to debates on the state and local tax deduction, Medicaid and more.

June 10 -

The dome of the U.S. Capitol Building in Washington, D.C., is reflected upside down in a puddle outside of the structure

June 2