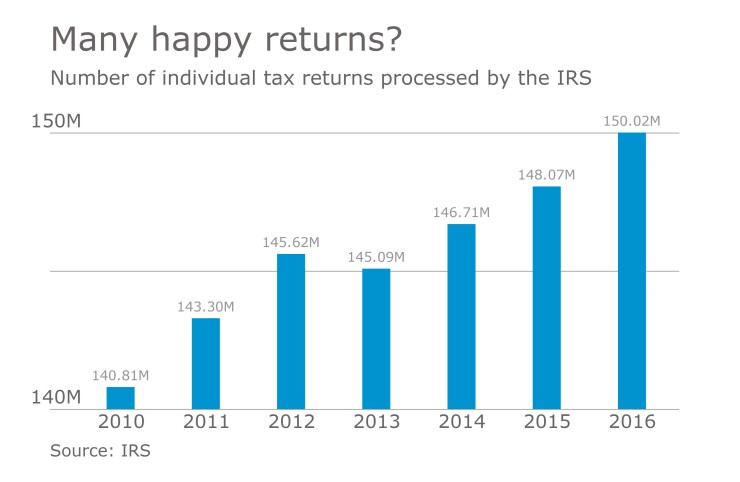

The IRS reports that it processed 150,018,266 returns from last season through Nov. 23. Income tax collected after credits was $1.416 trillion.

The figures cover the number of returns processed, adjusted gross income, tax liabilities, and the percentages of filers’ income composed of capital gains.

As of the day before Thanksgiving, the IRS had processed the largest number of returns for taxpayers with annual AGI of $50,000 to $75,000 (19,904,107 returns, for $101 billion in tax in tax revenue), $100,000 to $200,000 (18,291,156 returns, for $314.16 billion), and $30,000 to $40,000 (14,771,714 returns, for $26.2 billion).

The Excel sheet of figures in the service’s

The latest figures reflect nearly all returns that will be received and processed by the IRS in a calendar year, including timely filed returns that had been granted a six-month extension. The information presented primarily represents income earned in the prior year but will include some late-filed returns for earlier tax years.