Cryptocurrency

Cryptocurrency

-

The Internal Revenue Service warns virtual currency users they need to disclose gains on their tax returns.

March 23 -

More rush regulation; figuring reasonable compensation; software versus you; and other highlights from our favorite tax bloggers.

March 20 -

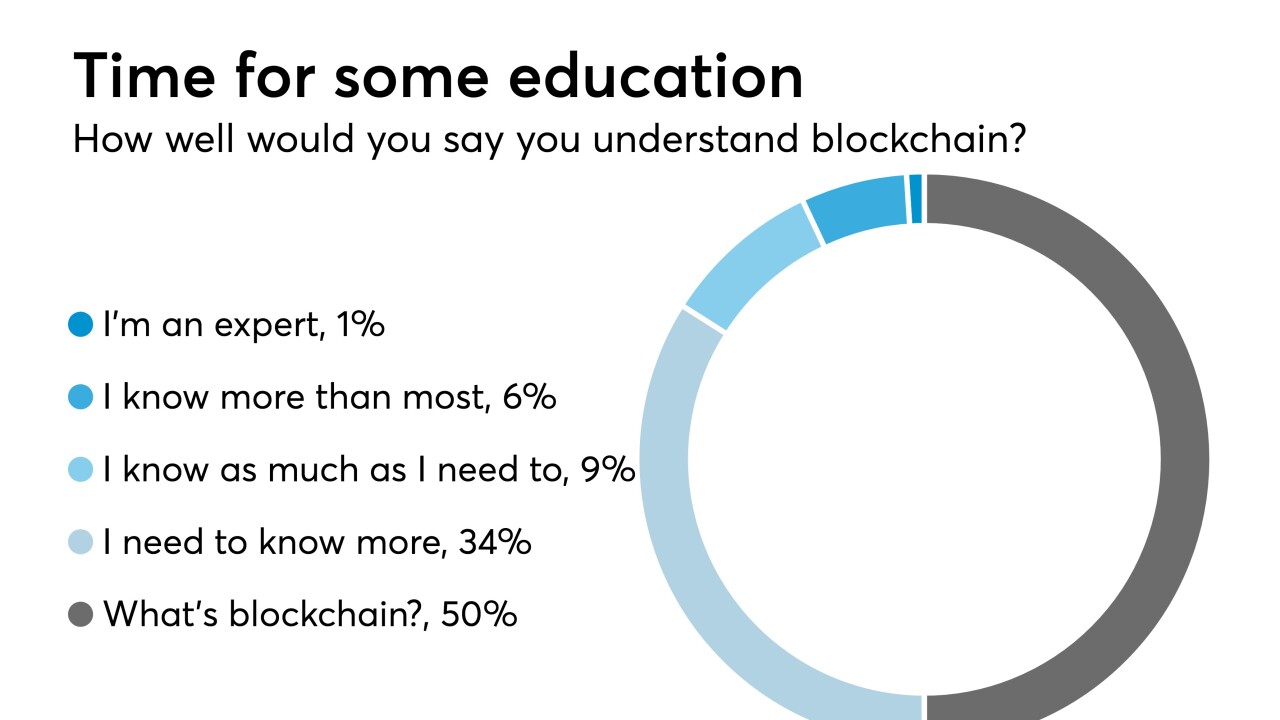

Blockchain is one of the hottest topics in the accounting and financial services field, but a substantial amount of uncertainty remains.

March 13 -

Clients may face unexpected tax consequences from transactions with these digital assets.

March 13 -

This year may bring a barrage of questions from clients about cryptocurrency. Here's how to be ready for them.

February 26 -

Blaming Woodrow Wilson; why to benchmark; the Advocate speaks; and other highlights from our favorite tax bloggers.

February 21 -

The Association of Certified Fraud Examiners appointed a new CEO and president, Bruce Dorris, succeeding longtime leader Jim Ratley, who will be retiring.

February 9 -

The Internal Revenue Service, fresh off its success in uncovering U.S. assets hidden in Swiss banks, has assigned elite criminal agents to investigate whether Bitcoin and other cryptocurrencies are being used to cheat the taxman.

February 9 -

In the coming years, the industry will play a significant role in driving the adoption of this world-changing technology.

February 7 -

Tax professionals need to be ready when clients have questions.

February 2 -

Reform and expats; R&D to OSs; and other highlights from our favorite tax bloggers.

January 30 -

Since I was at Davos last year there have been some seismic global changes, not least to taxation.

January 26 -

Repositioning real estate; state-level changes; the future of prep; and other highlights from our favorite tax bloggers.

January 16 -

U.S. Treasury Secretary Steven Mnuchin said he will work with the Group of 20 nations to prevent cryptocurrencies such as bitcoin from becoming the digital equivalent of an anonymous Swiss bank account.

January 12 -

The event is free of charge for attendees, and will address subjects ranging from blockchain technology to diversity and inclusion in accounting.

January 12 -

States’ SALT pushback; taxes and the Golden Globes; coining a new investing phrase; and other highlights from our favorite tax bloggers.

January 10 -

Happy Tax, a growing tax franchise, has opened a new tax preparation division aimed at the burgeoning cryptocurrency market.

December 21 -

Intuit's TurboTax and H&R Block are providing advice to people who invested in digital currency.

December 8 -

Virtual currency owners experiencing the thrill of record high values should take note that the IRS is stepping up enforcement.

December 8 -

Coinbase Inc. lost a bid to block an Internal Revenue Service investigation into whether some of the company’s customers haven’t reported their cryptocurrency gains.

November 29