Crowe Horwath LLP has issued a year-end tax-planning guide with information on income tax deductions, investments, retirement and estate planning and tax rates, along with what to do about the uncertain state of the tax extenders legislation in Congress.

In

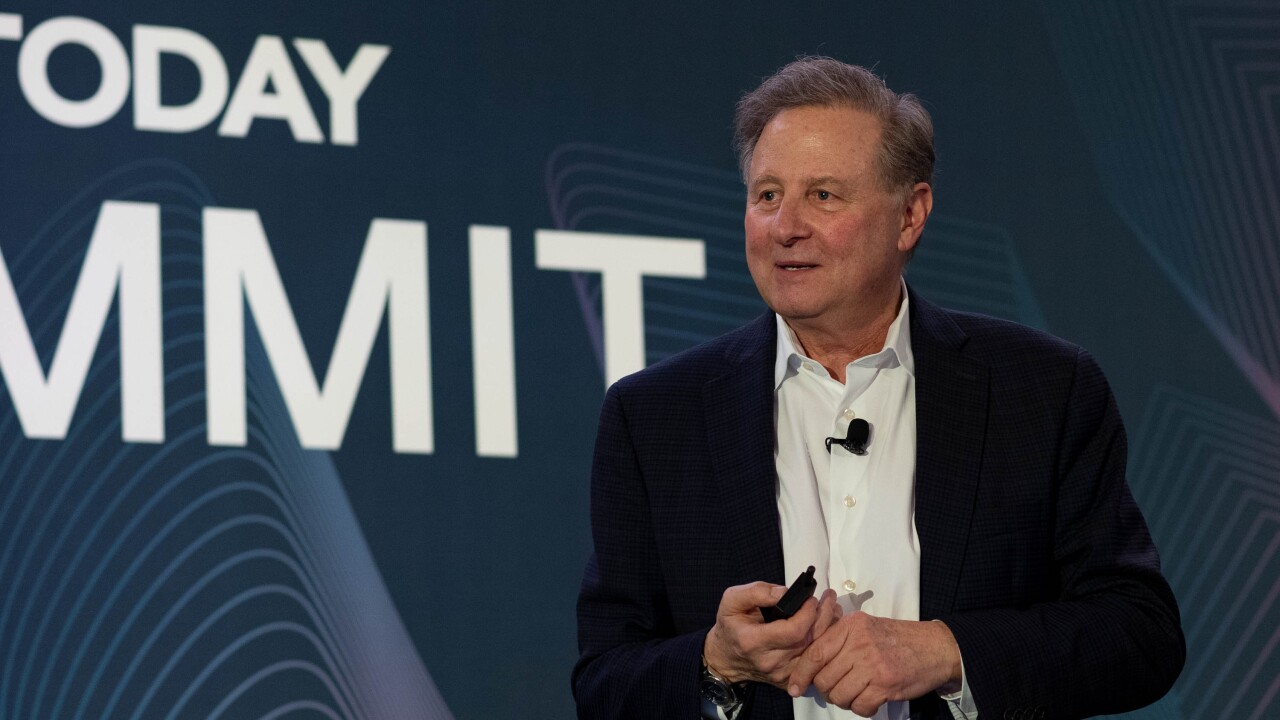

“The tax extenders weren't signed into law until late in December last year, and there's no indication that they won't be extended again this year,” said Gary Fox, managing partner of Crowe Tax Services, in a statement. “However, taxpayers need to be flexible and cautious for the time being, since their extensions aren't guaranteed.”

For businesses with 100 or more employees, the firm noted this is the first year that the Affordable Care Act’s play-or-pay provision is in effect. Under the ACA, premium tax credits are available to employees who enroll in a qualified health plan through a government-run health insurance marketplace and meet certain requirements – but only if they don't have access to “minimum essential coverage” from their employer or the employer plan offered is "not affordable" or doesn't provide “minimum value.” If the employer is obligated to provide health insurance and just one employee receives a premium tax credit, the penalty may apply. Beginning in 2016 employers with 50 or more employees will also be subject to the ACA play-or-pay provision.

“The detailed guidance of the ACA is extensive, but it includes some exceptions for mid-sized businesses,” Fox said. “If your business could be subject to the penalties this year or next, review your workforce and coverage offerings. There may be changes you could make to avoid or minimize penalties, or it may be cheaper to pay the penalties. However, it's important to remember that penalties aren't deductible, and not offering healthcare coverage could make it harder to attract and retain the best employees.”

Fox noted that individuals should pay close attention to see if they're subject to the alternative minimum tax. Individuals must pay the AMT if their AMT liability exceeds their regular tax liability. This occurs because AMT preference items, such as the state income tax deduction, are not deductible for AMT purposes. Individuals can use planning strategies to help mitigate the AMT tax burden.

“Individuals need to pay close attention to the income their investments are earning so they're not caught off guard,” he said. “Tax-exempt interest from certain private-activity municipal bonds can trigger or increase the AMT in some situations.”