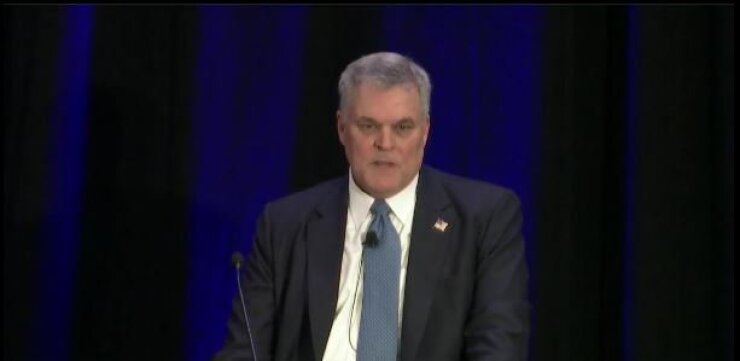

Chuck Rettig, who was confirmed as commissioner at the Internal Revenue Service last fall, sent an email to employees at the agency who are struggling with the partial government shutdown that is forcing most of them to work without pay for over a month.

“As hard-working employees of the IRS, our agency has an important mission to fulfill on behalf of the American public,” he wrote last Friday. “The current lapse in appropriations creates challenges for the workforce, both personally and professionally, and I wanted to share some thoughts and information with you as we continue to work through these various issues. IRS employees take great personal pride in our mission. You have a long, distinguished track record of rising to challenges to support our vital mission on everything from the filing season to natural disasters. I am truly proud of the workforce and honored to lead such dedicated individuals.”

Rettig offered his support to the agency's employees. “The senior leadership team and I understand that this is a difficult period for many of you and your families,” he wrote. “The government shutdown has created financial hardships for many of our employees. Be assured we have had teams from the Human Capital Office and across the service working non-stop to help you address your issues and needs.”

He also offered some reassurances as federal employees are set to miss their second biweekly paychecks on Friday. “I know that a major concern for you centers on your paychecks and when those might resume,” he wrote. “Congress passed and the president signed into law a bill that will back pay government employees once the lapse ends. To help speed this process along, HCO will work quickly to process the payroll when the government reopens so you can be paid as soon as possible. I understand this team did remarkable work on this detail-heavy process during the last lengthy government shutdown in 2013, and they are prepared to help again.”

Last week, the Treasury Department released a

Hundreds of IRS employees are reportedly taking “hardship exemptions,” according to the National Treasury Employees Union, allowing them to stay away when they can’t afford to pay for necessary expenses such as transportation costs, childcare or gasoline (see

“As many of you know, we are in the process of recalling people to assist with filing season and other pressing issues,” he wrote. “I’m directing our senior leadership team and managers to work with recalled employees who face hardships, keeping in mind we have [Office of Personnel Management] guidelines as well as our 2019 National Agreement to follow.”

Rettig expressed his thanks to the embattled staff at the agency. “I also want to share my thanks with the many dedicated employees across the IRS who have been hard at work throughout the shutdown,” he said. “About one in eight of our employees – nearly 10,000 – have been working in some capacity since the shutdown began on Dec. 22. Their efforts during the holiday and new year have been remarkable.”

He advised employees to check out some of the information available online for them. “You have our commitment that we will continue to do all we can to assist IRS employees during this time,” he wrote. “I encourage you to review the resources available at

Rettig was confirmed by the Senate last September and took the helm at the agency as it worked to implement the wide-ranging tax overhaul passed by Congress at the end of 2017. This tax season promised to be a difficult one even ahead of the partial government shutdown as the IRS worked to update its forms and computer systems to handle the extensive changes in the Tax Cuts and Jobs Act.