Small businesses are the cornerstone of many an accounting practice – but not all small businesses are the same, with some sectors representing better opportunities that others.

That’s why Accounting Today broke down the results of its

From that analysis, the research team created two numbers to serve as indicators to help accountants assess each industry:

- The Accountants Affinity Index. This rates how much an industry is currently tapping into the expertise and services of the accounting profession, based on whether the small businesses in it reported using accounting services in 2018, and whether they said they were “Very likely” to use accounting services in 2019. The more services they reported using or being very likely to use, the higher their affinity ranking.

- The Opportunity Score. This is a gauge of the depth of need for accounting services in a particular sector (measured by how many services they are currently using or planning to use) and the sector’s overall financial strength (based on reported profitability).

In theory, affinity and opportunity can conflict – a sector could have a high Affinity Index because it already makes use of a large number of accounting services, and a saturated market like that could be hard to build a new practice in. In practice, though, few sectors have anything approaching saturation, with plenty of room for growth – assuming the businesses are interested in accounting services.

Over the next few weeks, Accounting Today will share the results for some of the small-business sectors that offer the greatest Composite Scores, meaning they offer an above-average combination of affinity and opportunity. The first installment is below, covering the industry with the highest Affinity Index and the highest overall Composite Score – health care.

The state of the sector

When it comes to businesses in the health care sector, most people think of large hospitals, medical device companies and the like – but by far the vast majority are actually physician practices or dentists’ offices, which means they are very small businesses in a field with very complicated financial and accounting needs.

Medical billing and accounting are famously complex, and the sector faces a host of other issues, as well, including:

- Ongoing revolutions in technology, both for medical treatments and for record-keeping and practice management (which bring along with them significant demands for capital).

- Massive changes in models for health care delivery and assessment.

- Tremendous uncertainty in the insurance landscape, not least surrounding the fluctuating fate of the Affordable Care Act.

- Widespread consolidation, as large hospital networks snap up individual practices.

Despite those challenges, small businesses in the health care space are, generally, in pretty good shape, particularly when compared with the universe of small businesses as a whole.

They’re a few points ahead in reporting a profit in 2017 (71 percent versus 69 percent of small businesses overall), with much fewer reporting operating at a loss (2 percent, versus 6 percent overall). They were much more likely to report having increased their revenue in the previous 12 months (61 percent of health care businesses, versus 52 percent of small businesses overall) – though they were no more likely to have grown their profits.

They generally have high expectations for the coming year: Over 70 percent of them expect to increase their revenue and their profits. They are, however, planning mostly on holding the line on staff, with 73 percent expecting employee numbers to remain the same.

Two final points about small health care businesses: They tend to be both older and slightly larger than the average small business. More than four-fifths (82 percent) are five or more years old, and 55 percent are more than 10 years old; and 61 percent have between one and 10 full-time employees (versus 73 percent of overall small businesses.

The opportunity for accountants

The health care space’s Composite Score of 1.10 was the highest of any industry in the Small Business Accounting Insights Survey, and that was mostly driven by its Affinity Index number of 1.47 – which was also the highest recorded. However, it had one of the lowest Opportunity Scores, at 0.74. (For all three numbers 1.0 is average for all small businesses.)

That low Opportunity Score is not a function of expected profitability; instead, it’s a result of above-average interest in core offerings like bookkeeping, tax planning, tax services, and payroll. While the field hasn’t hit saturation levels yet on those services, it’s closer than many of the other sectors, and the strongest opportunities for accountants may come from educating clients about the value of some of their other services. For instance, literally none of the respondents were interested in fraud or forensic accounting, despite the fact that fraud is an enormous problem for physicians’ practices.

Cash flow is the most common challenge facing small businesses, and the health care sector is no exception, with 31 percent of respondents saying their organization had had problems in this area in the previous 12 months – on par with 32 percent of small businesses overall.

They were less likely to report problems with low profitability (24 percent, versus 31 percent of small businesses overall), but they were much more likely to report having had to face some kind of non-tax or non-sales-tax-related audit. While only 10 percent of small businesses overall reported this kind of problem, 18 percent of health care small businesses had faced them – which is not necessarily a surprise in a sector that has to answer to insurers, state and federal regulators, and various government payors, all of whom are on the alert to keep quality of care up, and mis-billings and fraud down.

Fortunately, when it comes to financial challenges, small health care businesses were quick to consult their accountants, with 45 percent reporting seeking their outside advice in moments of need (versus 34 percent of small businesses overall).

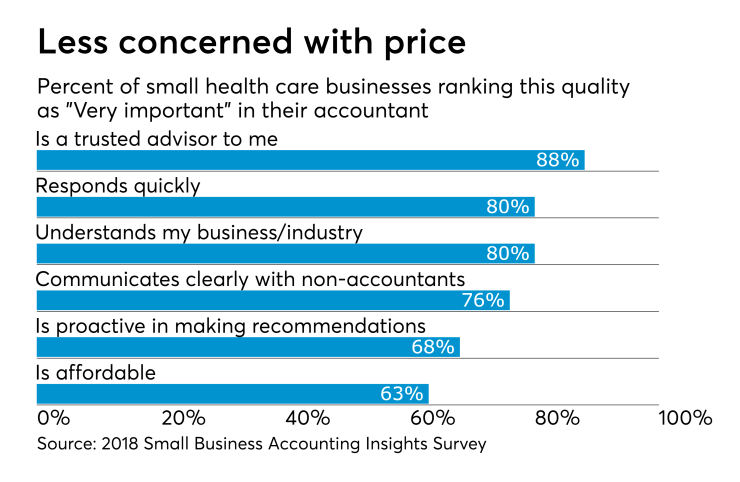

What’s more, this is a field that uses and values their most trusted advisors: Four-fifths of them (80 percent) reported having received services from their CPA or accountant in 2018, against just half of small businesses overall, and they were mostly very satisfied (77 percent) or somewhat satisfied (13 percent).

KEY TAKEAWAYS: SMALL BUSINESSES IN HEALTH CARE

- Affinity Index: 1.47

- Opportunity Score: 0.74

- Composite Score: 1.10

While strongly engaged with their accountants, they need to be educated about services beyond the traditional core. Given the complexity of the field and the enormous changes ahead for it, they are ripe for a host of advisory and planning services, from business model advice to IT consulting.