While tax professionals are preparing for the Jan. 27 start to the 2020 filing season, they should also be planning their marketing strategy for the year ahead, according to Chuck McCabe, president of Peoples Income Tax and The Income Tax School.

“Every year a tax practice will lose some clients, so marketing is vital just to stay even,” he said. “And it’s vitally necessary for professionals that want to grow their practice.”

“So if you haven’t already started developing a marketing plan for 2020, now is the time, before the rush of clients begin coming through the door,” he advised.

McCabe suggested a number of marketing strategies to introduce in the new year.

Segment your email list

“Consumers have come to expect personalization,” he said. “They expect quick and easy customer service, and marketing emails and campaigns tailored to their needs. That means that digging through a long email newsletter to find information that is relevant to them is not ideal. An email that appeals specifically to them, however, is more likely to get their attention. This is where email segmenting comes in.”

Segmenting is simply dividing your email list into categories based on customer behaviors or interests, he explained: “For the tax industry that can be as simple as business versus individual clients. Depending on how much content you have to work with, you could dive deeper. There could be separate segments for younger taxpayers with children (that will eventually want to take advantage of tax-friendly savings plans), for older taxpayers at or nearing retirement, or for financially-savvy taxpayers with multiple investments. The key is to make customers feel they are being treated as individuals and to deliver content that is relevant to their needs.”

Diversify your content

“Tax professionals should avoid pushing out the same boring articles year after year,” McCabe said. “If they haven’t gained traction at this point, they never will. It’s time to shake it up and try new things. Try mixing it up this year with interactive content like Facebook or YouTube Live, more videos, animated GIFs, new blog topics, or even quizzes. Don’t lose sight of your regular blogging efforts, but add some new things to the mix like guest posting on other sites or LinkedIn Pulse posts on your personal linkedIn account.”

The flywheel over the funnel

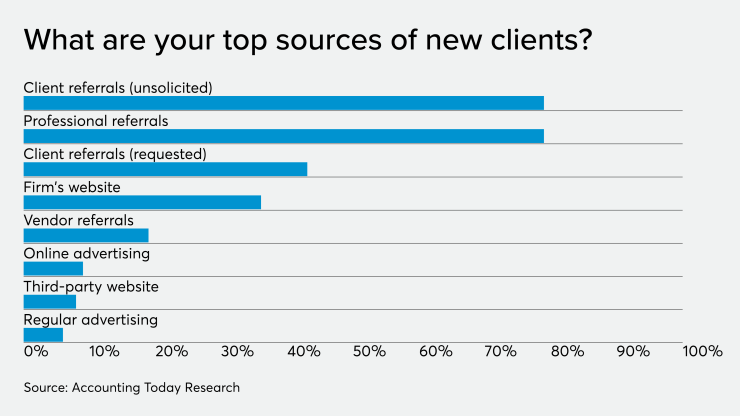

“Hubspot recommends the flywheel over the funnel,” McCabe commented. “Funnels lose their momentum at the bottom while flywheels use that momentum to keep spinning. Word of mouth, referrals, and influence marketing are still going strong and are more effective than ever. It’s time to ditch the digital marketing tactics of old, throw out the funnel and find ways to nurture clients who will bring in new business. Rather than just moving taxpayers through a funnel where they’ll drop off and be forgotten, focus on customer health so that they refer you to friends and colleagues.”

Client satisfaction is a component of successful "word of mouth" marketing, he noted. “When a client leaves your office after having their taxes prepared, it’s important that they have a positive feeling about the experience,” he said. “Part of that feeling comes from confidence that the preparer took note of their personal situation in applying the tax law for their benefit. They are likely to tell their friends and associates, and are more likely to continue to use your services.”

Update your website

“Websites are not a ‘set it and forget it’ technology,” McCabe said. “It is essential that the tax professional periodically check its performance. Is it mobile-friendly? How quickly does it load? How’s the user experience? Is the copy compelling?”

“Give your website a good look for clarity, consistency and ease of use,” he advised. “It should be helpful and informative to your current taxpayer clients, and compelling to the taxpayer in search of a preparer,” he added. “Tax law expertise, efficiency in operations, and client-friendly practices should be highlighted.”

Optimize for SEO

“Search engine optimization helps customers find you online,” McCabe commented. “If you’re better at it than your competitors, you end up at the top of the search results and are more likely to earn the business.”

There are some quick things practitioners can do to boost their SEO right away, but there are other, more technical tasks that may need doing as well, he said: “Having a blog explaining recent developments in tax increases your chances of ranking higher in search engine results by more than 400 percent. You can also make sure you have keywords and phrases on all of your website’s pages, ensure there are keywords in the alt tags of all of your images, and include internal links throughout your website. SEMrush is a free service you can use to help identify opportunities.”